Small Investors Are Snapping Up DFW Homes: What It Means for the Dallas-Fort Worth Market in 2025

Small Investors Are Snapping Up DFW Homes: What It Means for the Dallas-Fort Worth Market in 2025

As the Dallas-Fort Worth (DFW) metroplex cements its status as the hottest real estate market in the nation for 2025, a new wave of players is reshaping the landscape: small-scale investors. According to the latest Emerging Trends in Real Estate 2025 report from PwC and the Urban Land Institute, DFW tops the list for investment and development opportunities, driven by explosive population growth, corporate relocations, and a business-friendly environment. But while big institutional funds grab headlines, it's the everyday investors—individuals, family offices, and small groups—who are quietly fueling a surge in home purchases. These "mom-and-pop" buyers are targeting affordable suburbs and emerging neighborhoods, turning single-family homes into rentals or flips amid rising inventory and stabilizing prices.

In this deep dive, we'll explore why small investors are flocking to DFW, how their activity is influencing home prices and availability, and what it means for first-time buyers, sellers, and long-term homeowners in the metroplex. With median home prices hovering around $399,000 to $418,000 and inventory up 22% year-over-year as of 12:15 PM CDT on Saturday, October 11, 2025, this could be a pivotal year for the region's housing dynamics.

The Rise of the Small Investor in DFW: Who's Buying and Why?

Small investors—defined here as individuals or groups acquiring one to five properties annually—are making up a growing slice of DFW's buyer pool. Unlike large firms snapping up entire subdivisions, these buyers often leverage personal savings, local knowledge, and creative financing to enter the market. Recent data from local cash home buyers like DFW Investors and Dallas Property Investors shows they're purchasing 50-100 homes per year, focusing on "as-is" single-family properties for quick rehabs or long-term rentals.

What’s driving this trend? Several factors unique to DFW:

- Booming Population and Job Growth: The metroplex added 27,300 jobs last year alone, with sectors like tech, healthcare, and finance leading the charge. This influx—projected to add over one million residents by 2030—fuels rental demand, making DFW's 77% renter-occupied homes in areas like Munger Place prime targets for small landlords. Millennials and Gen Z, drawn to flexible living, are keeping occupancy rates high.

- Relative Affordability: At a median price of $399,000 in May 2025, DFW homes remain below the national median of $422,800, offering better value than coastal markets. Small investors are eyeing suburbs like Euless, Prosper, and Mansfield, where entry costs are lower and appreciation potential is strong (3-5% projected for 2025).

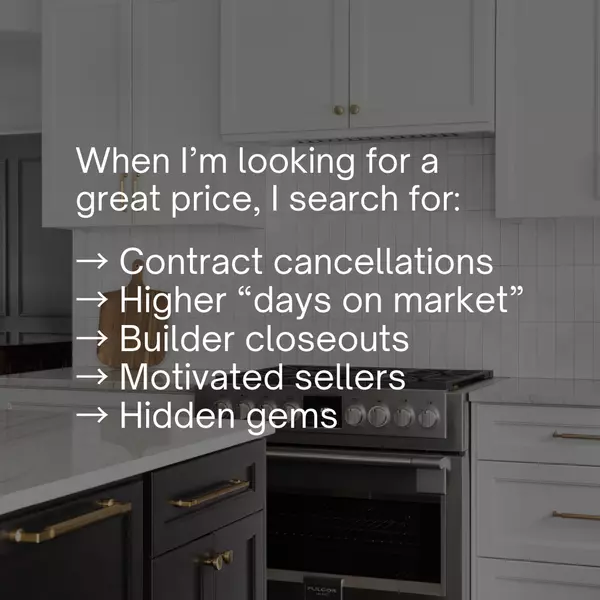

- Stabilizing Market Conditions: With sales down 2.51% year-over-year but inventory surging, small investors see opportunity in a less frenzied environment. Mortgage rates around 6.58% deter some traditional buyers, but cash-heavy small investors (like those using hard money lenders) can close fast without financing hurdles.

Nick Wooten, real estate reporter for The Dallas Morning News, notes, "DFW's consistent top-10 ranking in investment reports isn't just hype—it's fueled by accessible entry points for smaller players who know the local scene." Companies like JCA Freedom Home Investors echo this, buying "as-is" homes across North Texas counties to revitalize neighborhoods.

Hot Neighborhoods for Small-Scale Home Investments

Small investors are zeroing in on DFW's "path of progress" areas—suburbs and up-and-coming enclaves where growth meets affordability. Here's where the action is heating up in 2025:

- Frisco and Prosper (Collin County): These fast-growing suburbs lead in luxury family homes and new construction, with strong rental demand from tech professionals. Median prices: $500,000+, but cap rates around 5.7% make them appealing for rentals. Small investors here are flipping modern townhomes or holding for appreciation.

- Euless and Mansfield (Tarrant County): Affordable entry points ($350,000 median) near major employment hubs like DFW Airport. Ideal for single-family rentals, with 84-day average market time offering negotiation room.

- East Dallas and Near Southside Fort Worth: Urban revitalization spots like Bishop Arts District attract investors eyeing cultural hotspots. With rents at $1,419/month (down 1.5% YoY but still 13% below national averages), these yield steady cash flow.

- Emerging Lake Areas (Grapevine, Rockwall): Lakeside properties near Lake Grapevine or Ray Hubbard offer lifestyle appeal, drawing families and yielding 4-6% annual growth.

Zillow lists over 164 "investor special" homes in Dallas alone, many under $300,000—perfect for small-scale flips.

The Impact: Boosting Rentals, Stabilizing Prices, and Challenges Ahead

Small investors are injecting vitality into DFW's market, but their rise isn't without ripple effects:

- Rental Market Surge: With 77% renter occupancy in key areas, these buyers are expanding the single-family rental pool, easing pressure on multifamily units. Median three-bedroom rents hit $2,430 (up 3% YoY), but softening in apartments (down 1.5%) gives investors an edge. This helps young professionals and relocating families, but could sideline first-time buyers if inventory doesn't keep pace.

- Price Stabilization: Increased purchases (up in suburbs) counterbalance a 2.2% YoY median drop in Dallas County to $360,000, keeping overall appreciation modest at 3-5%. Homes now sit longer (57-84 days), giving everyone more breathing room.

- Potential Downsides: Lowball cash offers (30-70% of value) from aggressive buyers can frustrate sellers, and rising insurance costs (up 14.3% in multifamily) squeeze margins. Plus, with 71,788 new units authorized in 2024, oversupply risks loom if absorption slows.

Hilary Schultz, a licensed DFW Realtor and investor, warns, "Small investors are smart to focus on cash flow now, but they must watch rising costs—insurance and maintenance could eat into those suburban yields."

Advice for Buyers, Sellers, and Investors in DFW's Evolving Market

For first-time buyers: Shop suburbs like Prosper for value, and use the extra inventory to negotiate—2025 favors those who research local trends.

Sellers: Price realistically amid longer days on market, and consider investor interest in "as-is" deals for quick closes.

Aspiring small investors: Target turnkey rentals in high-growth areas like Frisco ($200,000-$250,000 entry), and partner with local lenders for hybrid cash-flow plays. Tools like Houzeo or Clever Offers can connect you to competing bids.

The Bottom Line: DFW's Investor Boom Signals Opportunity Amid Balance

As small investors continue to capitalize on DFW's resilience—ranking No. 1 for real estate in 2025—the market is shifting toward balance, with more options for all. While challenges like rates and costs persist, the metroplex's job engine and demographic pull make it a perennial winner. Whether you're eyeing a flip in Euless or a family home in Mansfield, now's the time to act as of 12:15 PM CDT on October 11, 2025.

Thinking of diving into DFW real estate? Connect with local experts today at our website. What's your take on small investors reshaping the market—boon or barrier? Share below!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

What’s your take on small investors reshaping the market—boon or barrier? Share in the comments below!